New Delhi: Ahead of the upcoming sixth anniversary of the Goods and Services Tax (GST) implementation on July 1, the government has unveiled a comprehensive list of items and services that have become more affordable since 2017.

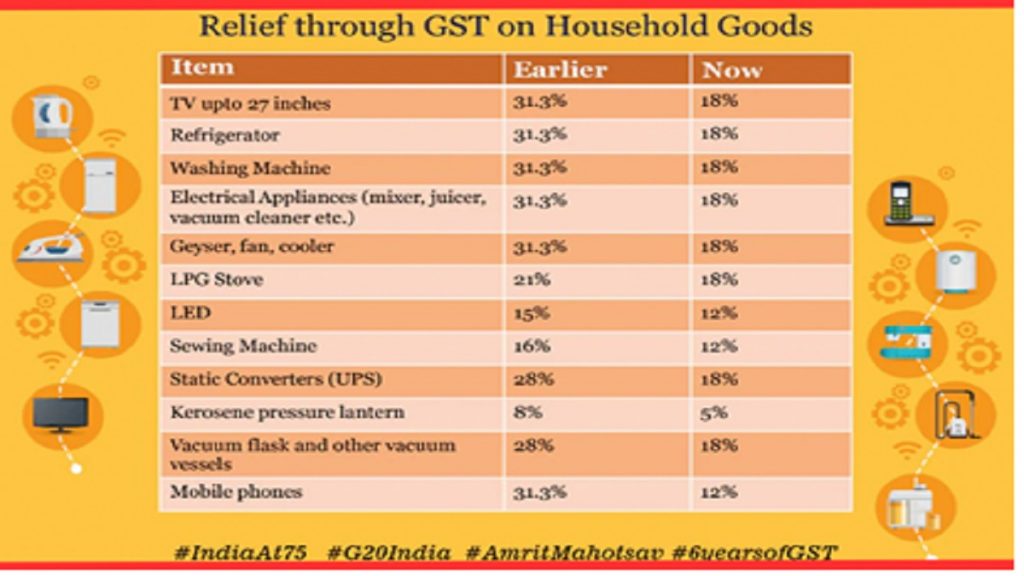

The reduced tax rates have brought relief to consumers, particularly in the household goods sector, including TVs up to 27 inches, refrigerators, washing machines, electrical appliances, geysers, fans, coolers, and mobile phones.

Introduced six years ago, the GST amalgamated 17 taxes and 13 cesses imposed by both the central and state governments. Since then, it has not only alleviated the tax burden on citizens but has also acted as a catalyst in boosting consumption across the country, according to a statement from the office of Union Finance Minister Nirmala Sitharaman.

The introduction of GST has yielded positive outcomes for the government’s revenue as well. Initially, monthly GST revenues ranged between Rs 85,000-95,000 crore at the time of its launch in 2017. However, over the years, these figures have witnessed substantial growth, with the current monthly revenues standing at around Rs 1.5 lakh crore and showing a continuous upward trajectory. April 2023 witnessed a milestone achievement when GST revenues reached an all-time high of Rs 1.87 lakh crore.

With reduced taxes, #GST brings happiness to every home: Relief through #GST on household appliances and mobile phones ??️#6YearsofGST #TaxReforms

#GSTforGrowth pic.twitter.com/LgjGQMbw6e— PIB India (@PIB_India) June 30, 2023

The reduction in tax rates for various household goods and services indicates a significant step towards ensuring affordability and accessibility for consumers. By making essential items such as TVs, refrigerators, and washing machines more affordable, the government aims to enhance the overall standard of living and drive consumption in the country.

The move is expected to have a positive impact on the economy, as it will stimulate demand and encourage individuals to invest in these essential household items. With the cost reduction, consumers can now enjoy the benefits of modern technology and convenience at a more reasonable price point.

This development aligns with the government’s continuous efforts to streamline the tax system, reduce complexities, and create a more consumer-friendly environment. As the GST completes six years of implementation, it serves as a testament to the successful consolidation of various taxes and cesses, ultimately providing a simpler and more efficient tax structure for the nation.