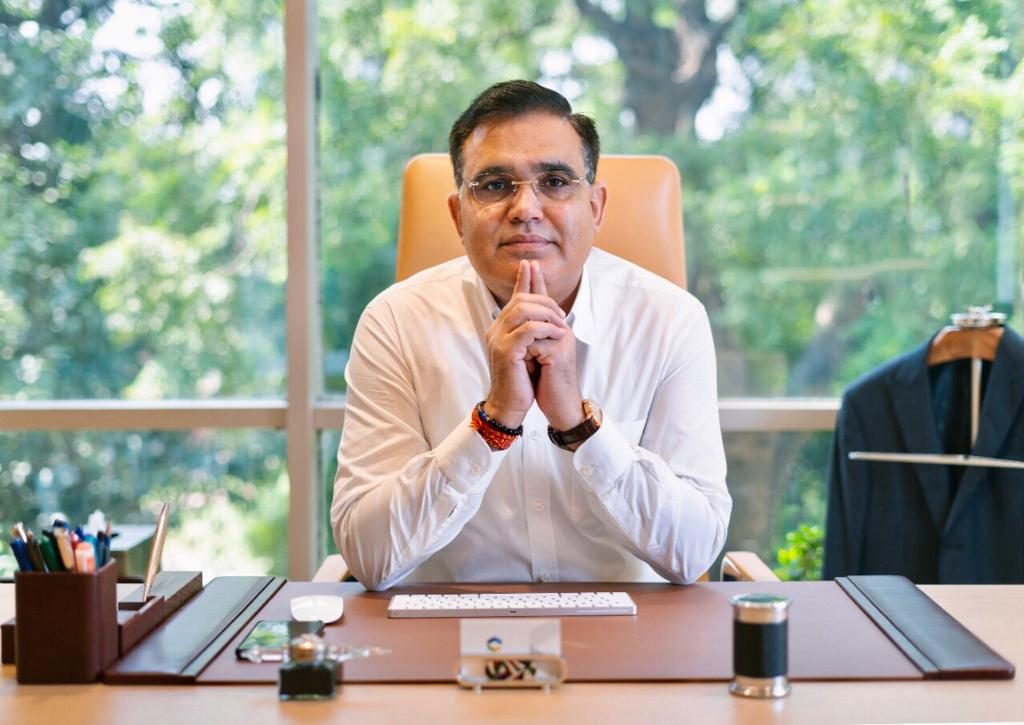

SK Narvar, Chairman, Capital India Corp., believes that for India to become an economic superpower, every Indian, however small or marginalized, should have access to organized credit and lending facilities. We can achieve it through digitization, and fintech will be a crucial driver to scale up and mainstream every Indian’s financial footprint.

His views on the interview are as below:

1. How do you view PM Modi’s assertion that India needs a fintech revolution?

S K Narvar: PM Modi’s vision of a fintech revolution for every Indian is a dream coming true in this decade. Various research has shown that traditional banking protocol of a financial footprint has left many Indians especially, small and marginalized Indians, out of our economic system. With the setting up of new bank branches becoming cost-prohibitive, fintech is a strategic way to enable every Indian to access finance cost-effectively, secure, and secularly.

As PM Modi mentioned, fintech rests on the four pillars of investments, income, insurance and institutional credit. As these get democratized with every Indian able to access them, the nation’s progress toward socio-economic self-sustainability becomes a reality.

2. How will fintech help India’s financial ecosystem and players?

S K Narvar: First and foremost, India’s fintech (r)evolution has witnessed amazing domestic innovation and start-up entrepreneurship. Today many bright Indian young minds, especially engineers and finance whiz kids, are solving the country’s payment, lending, and distribution reach through technology.

In parallel, we have seen traditional banks and NBFC’s partner with innovative fintech’s to create affordable, transparent and speedier products and solutions for the non-banked Indian population. As a result, fintech has created an agile and scalable opportunity for the Indian financial ecosystem, leading to market expansion and untapped customer opportunities.

3. Is there a viable business opportunity, or will such innovations not be practical in a cost-conscious market like India?

S. K Narvar: According to published data, India’s fintech industry will be valued at $150 billion by 2025 from $50-60 Bn in FY 20. The fintech transaction value is set to grow from $66 billion in 2019 to $138 billion in 2023, with a CAGR of 20 per cent. India is amongst the fastest growing Fintech markets globally – out of the current 2100+ fintechs existing in India today, over 67% were born in the last 5 years.

The above clearly shows a viable market opportunity. Through fintech, the cost per transaction will be coming down while volumes will drive revenues as India is a large market play. Further, fintech will disrupt current financial players, especially in lending, insurance, money transfer, wealth tech, and personal finance.

4. Is a large number of fintech’s a worry from a regulatory viewpoint?

S K Narvar: Along with India’s financial regulator, the government is putting across robust and world-class regulatory norms pre-empting new risks. The Joint Working Group (JWG) in fintech is the government’s initiative to create better regulatory connect, improve earnings and create closer collaboration between India and countries like UK & Singapore.

India needs to be at par in terms of fintech with other nations. Hence, rules and regulations will evolve to ensure that innovations and disruptions continue while any deviations are identified and corrected.

5. What is your personal view of the fintech revolution?

S K Narvar: As a business group and promoter of Capital India Corp, we are actively involved in India’s fintech journey. We have a few of the most innovative fintech start-up companies, having invested in them to become leaders of tomorrow. I believe new-age financial institutions like neo-banks, mobile & app-driven financial transaction platforms with a physical branchless model have tremendous opportunities in India’s financial landscape.

Various government measures like Jan Dhan Yojana, e-RUPI, India Stack and Financial Literacy are a cornerstone of India’s fintech movement. With both urban and rural India being connected with high-quality broadband internet services and high mobile phone penetration, fintech will usher India’s march towards financial inclusion and empowerment especially, for Indians without traditional banking footprints (records).