New Delhi: In Budget 2022, the Government had announced its decision to impose 1% TDS on all crypto/virtual digital asset transfers. On Tuesday (March 8), Finance Minister Nirmala Sitharaman said the government is seeking a possibility of revenue in crypto.

The announcement was made not only on the 1% TDS on crypto transfers, but the government also announced a flat 30% tax on profit from crypto transactions.

About TDS on crypto trading

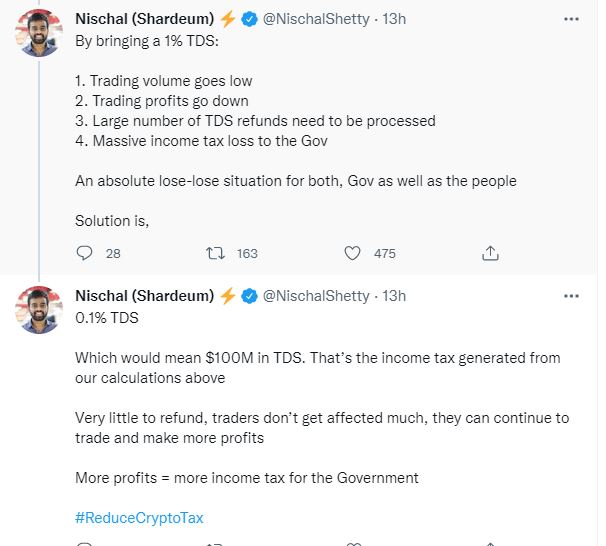

Nischal Shetty, founder of WazirX founder said that 1 per cent TDS on crypto trading will result in huge loss of tax revenue for the Government.

According to his calculations 1% TDS on Crypto trading shows:

1. The trading volume will go down.

2. The profits on trading will also go down.

3. Also, a large number of TDS refunds will need to be processed.

4. Meanwhile, the govt will have to face massive income tax loss.

He further said that the solution to this “lose-lose situation” for both crypto traders and Government is 0.1% TDS, which means $100M in TDS.

In a series of Tweet, he tried explaining about how the TDS is going to effect; check out his Tweets here

‘

‘

Here is who said what:

Also, Co-Founder and CEO of Giottus Cryptocurrency Exchange-Vikram Subburaj said that with 1 per cent TDS on crypto trading, the frequent traders may fall short of capital for every trade. He said short term traders would need clarity on how much of capital that can be locked against a PAN card in a year.

According to Sandeep Jhunjhjnwala, Partner, Nangia Andersen LLP, the TDS on crypto trading might result to cash flow issues for the buyer who will have to arrange funds to deposit taxes with the exchequer.

Nithin Kamath, Zerodha CEO and co-founder, also said that the Crypto volumes in India will drop off the cliff come July 1st 2022 soon after its implementation.

On the other hand, the Crypto industry stakeholders, including crypto investors and traders are demanding a reduction in crypto tax and TDS rate.