New Delhi: The stock markets gave a strong thumbs-up to Finance Minister Nirmala Sitharaman’s Budget 2021-22 as the benchmark indices Sensex and Nifty witnessed sharp surge and ended the day, 2314 and 646 points higher respectively.

As the Finance Minister Nirmala Sitharaman unveiled measures for historic roadmap to the economic recovery, it reflected in the stock markets with the latter cheering the announcements intra-day and the rally continuing till the closing bell.

BSE benchmark index S&P Sensex, ended 2,314 points higher at 48,600 and NSE Nifty 50 index gained 646 points to 14,281. This is once in a life time jump seen on Budget day, with Sensex and Nifty rising over 5% each. In fact, the Sensex recorded its best Budget Day, today.

Gains in the domestic indices were mainly led by banking, financial and auto stocks.

The Nifty Banks also hit all-time high as government proposed to recapitalise banks with about Rs 20,000 and with an objective of cleaning up the NPAs in the sector.

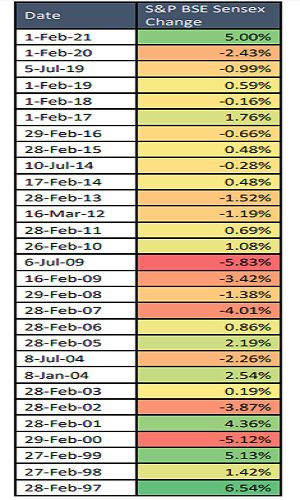

5% jump in Sensex, highest in 22 years

The Budget presented by Nirmala Sitharaman impressed the investors at Dalal Street a lot, as the same was reflected in the surging numbers at stock markets.

According to official reports, the rise of 2300 points is the highest ever rally in Sensex in the entire history of nation since Independence while in terms of percentage jump, the 30-share index logged its highest rise of 5% in last 22 years.

As is evident from the table above, last such surge in Sensex (on Budget Day) was witnessed in 1999, when the Sensex rose 5.13%, about 22 years ago.

Analysts believe the budget’s focus on healthcare, farm sector and opening up of insurance sector triggered positive sentiments on the markets, eventually showing up in rallying numbers.