New Delhi: The nitro benzene manufacturer, Sadhana Nitro Chemicals, has offered huge returns to investors in last 10 years, on back of mamoth returns of about 27,000 percent. This means that if an investor had put just Rs 10,000 in the company stock, then it would have turned inot Rs. 27 lakh today.

Looking at its share statistics, one gets to see insane rise of 1,098 percent in its stock. This also took the company to list among the top Indian Nitro Chemical manufacturers.

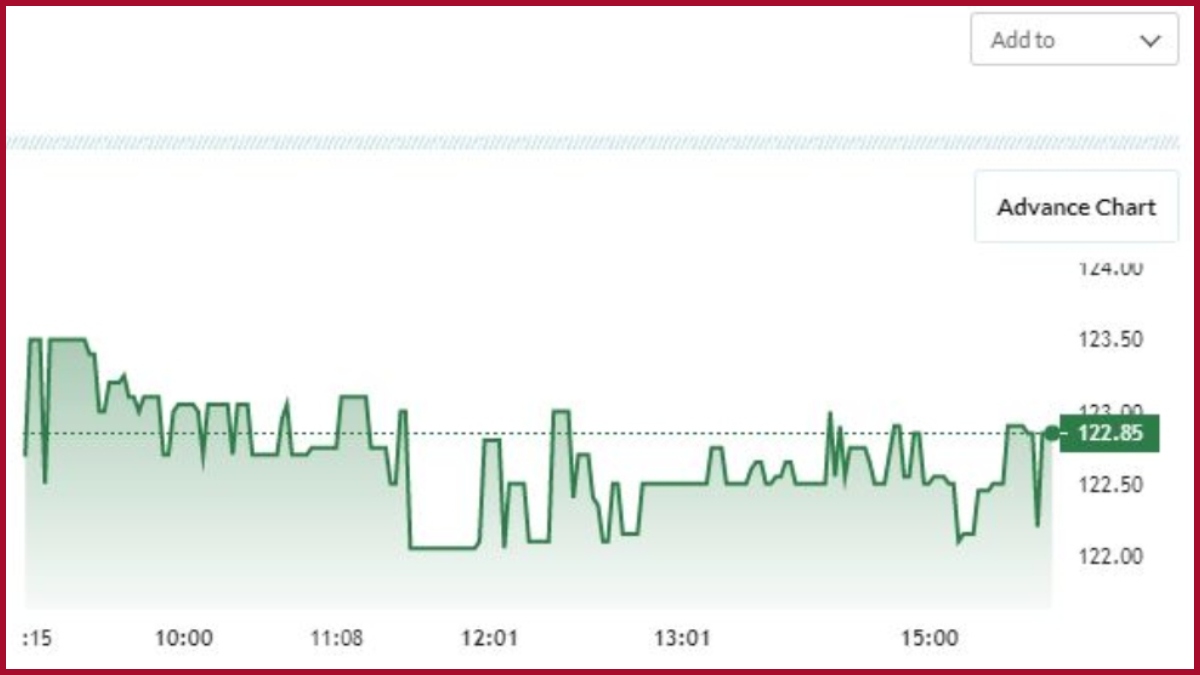

This is the company’s stock price graph. Courtesy: money control

Understanding the performance of Sadhana Nitro Chemicals

The company, founded in 1973, produces nitro benzene and Meta amino phenol. It basically manufactures organic chemicals and dye intermediates. The company’s sales operate in both domestic and export geographical segments.

Talking about the shareholdings of company, it is majorly owned by promoters at nearly 74.02 percent while the rest 25.97 percent is owned by the public, according to the financial and business portal, Money Control. Among the public holdings, the major portion of the company’s stake is owned by retail favorites at around 26 percent.

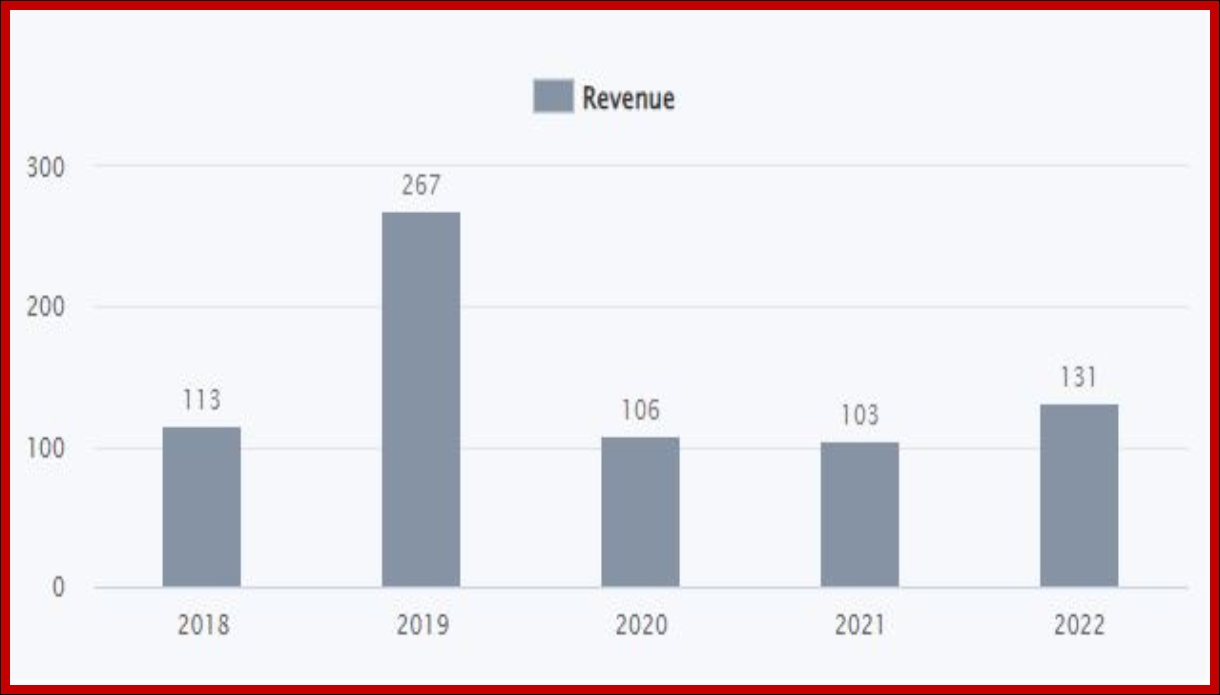

The nitro chemical manufacturer holds a market capitalization of Rs. 2,483 crore, which makes it a small cap company in nature. Additionally, its Trailing Twelve month EPS (earning per share) is 0.10, while the PE is 1,228.50, according to the data by Money Control. Reports also claim that Sadhana Nitrochem has witnessed a surge in company sales from Rs. 71.53 crore in financial year 2013 to Rs. 131.72 crore in FY 2022. On the other hand, the revenue graph too depicts the depth of the company.

What should the investors do?

Analysts see a wave of downturn wave in Sadhana Nitrochem stock. It may have a bearish outlook in the coming weeks. Apparently, it is because of the company trading below average level.