New Delhi: Fintech platform, Paytm’s parent company, One97 communications, witnessed a share surge of over 5 percent on May 8. The upsurge came after the company recorded an appreciative performance in the March 2023 quarter with an outpour in its operational numbers for April 2023.

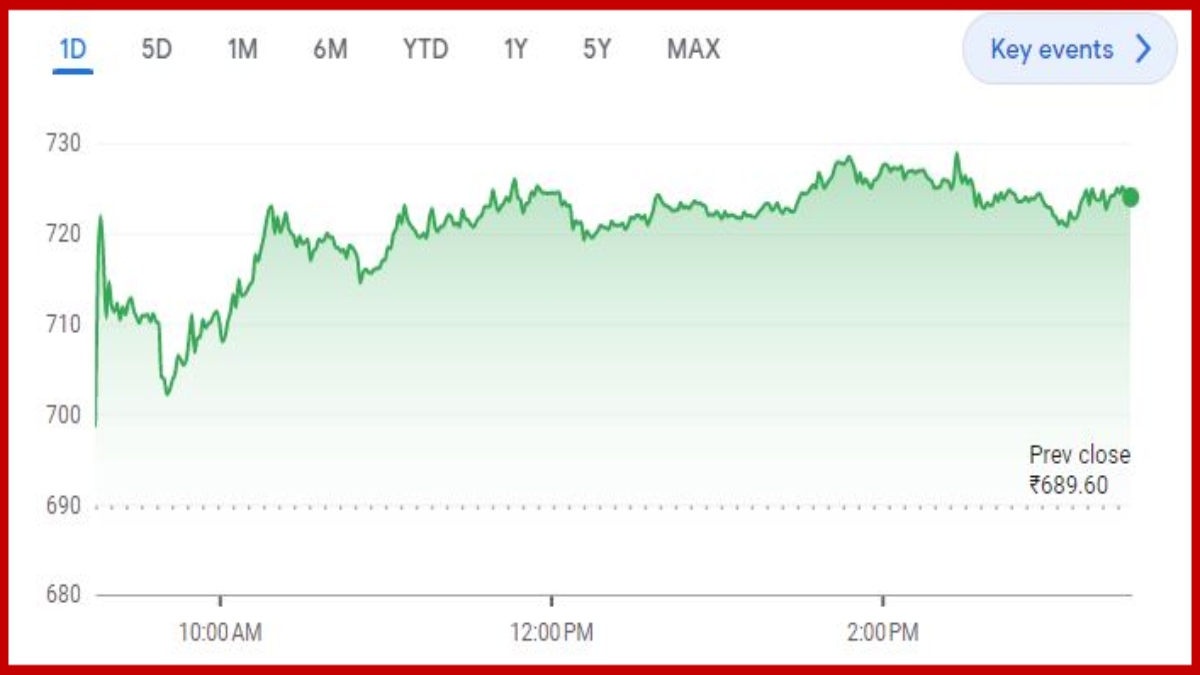

The shares rose to Rs 725.60 before slightly reversing course at Rs 708. Its market valuation was marked at more than Rs 44,750 crore. The stock’s closing price on Friday was settled at Rs 689.45.

Including its UPI incentives, the company reported its EBITDA at Rs. 101 crore for Q4 in comparison to last year’s Q4 numbers at Rs. 368 crore. It already achieved its operating profitability in Q4 of financial year 2022, which was much ahead of its 2024 guidance. In this financial year, Paytm’s net payment margin jumped 2.9 times, scaling to Rs. 1,970 crore.

Talking about its revenue performance, Paytm reported a 51 percent upswing to Rs. 2,334 crore in Q4FY22. Meanwhile, the revenue of this financial year stood at Rs. 7,990 crore, marking a 61 percent increase. At the company’s advantage, Paytm has also recorded a reduction in its net losses for last year’s March quarter and for this year’s Q4 as well.

Witnessing company’s strong performance in the fourth quarter, brokerage firms are responding positively to Paytm, as per reports. Analysts suggest a profitable future for the company, citing its rich business momentum and improved figures.

Dolat Capital, a trading company, opined that the growth momentum is projected in two stages, where we expect 25.5 percent of revenue CAGR in FY23 – FY30E and the second stage revenue CAGR of 15.6 percent in FY30 – FY40E. It also gave a buy call and a target price of Rs. 1,250. Meanwhile, it also stated that Paytm’s sustained profitability maintains our positive stance on it.