New Delhi: Adani Group stocks continue to face market value erosion ever since the Hindenburg report on January 24 set off downward trend in many of its flagship companies.

The downward rally in many of Adani Group stocks has robbed investors off lakhs & crores and those stay invested are in constant fear of their depleting wealth.

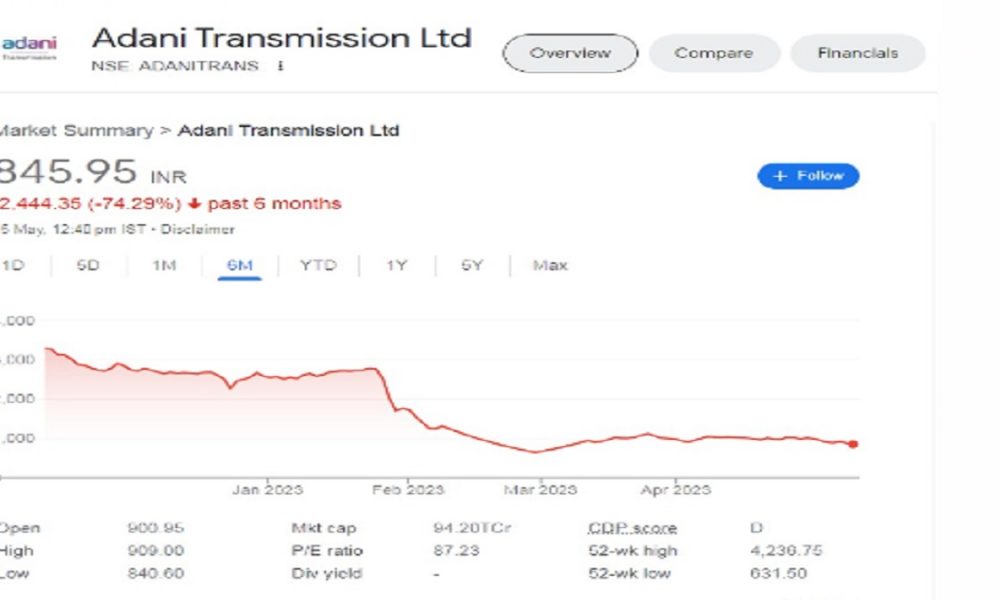

Adani Trasmission, headquartered in Gujarat and one of the leading private sector power transmission companies has its assets bleeding and fortunes plummeting for a long period. Today, the stock price went below 75% of its original price, on back of continuous downtrend in the stock over past 6 months.

Adani Transmission stock today registered a fall of about 5% despite the company exiting the Additional Surveillance Measure (ASM) framework. The ASM is a mechanism of Securities & Exchanges Board of India (SEBI) via which it categorizes shares & stocks depending on their volatility & price variations. Stocks which are included in the SEBI’s ASM list have an attached warning for investors that these stocks are highly volatile & one must weigh his/her chances before investing in them.

Adani Transmission was not the alone stock of Adani Group to suffer sharp drop. Apart from Adani Tranmission, 2 other group stocks namely Adani Total Gas & Adani Green Energy Ltd also made an exit from the ASM list, still they plunged to new lows.

Adani Transmission was seen slipping upto 4.999% and was trading at Rs 840/ per share. Adani Total fell about 5% with lower band price of Rs 777.45 while Adani Green dropped 3.27% lower to trade at Rs 866.70.

Notably, the Hindenburg Research, US based short seller had in its January 24 report triggered chaos in the Indian stock markets with its claims that it had taken several short positions in Gautam Adani-led conglomerate and the latter’s accounts were ‘highly inflated’. It also accused Adani Group of stock manipulation & accounting fraud.