New Delhi: The stocks of beleaguered Adani Group remain in free-fall mode, with most flagship firms registering a steep decline in valuation on Wednesday. The 10 stocks from billionaire Gautam Adani’s empire witnessed another round of sell-off, with a couple of them hitting the lower circuit.

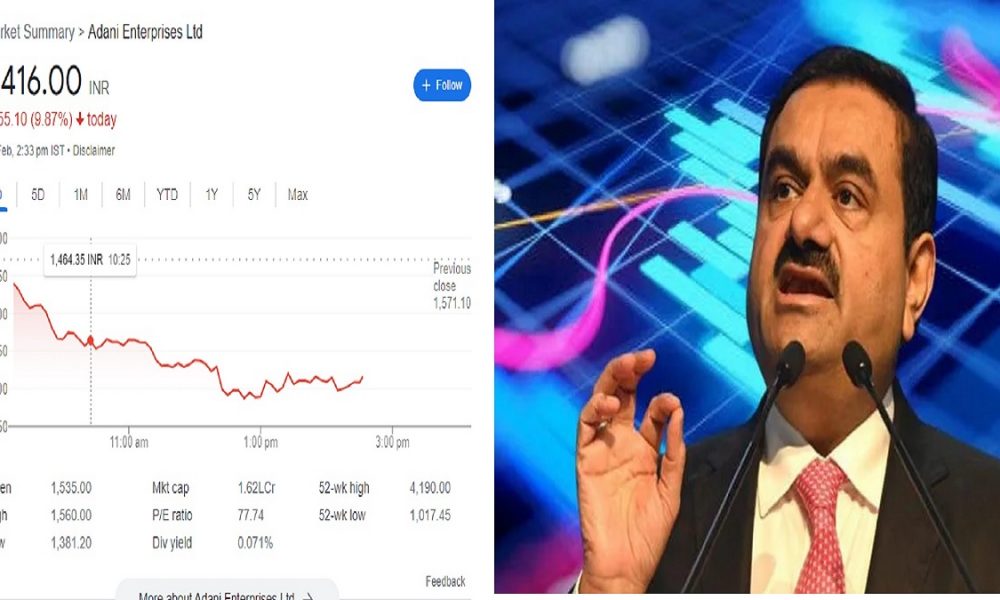

Adani Enterprises, the flagship firm of largest Indian conglomerate, recorded a steep fall of upto 10% on Wednesday while four other leading stocks – Adani Transmission, Adani Gas, Adani Green & Adani Wilmar were locked at 5% lower circuits. Adani Enterprises stock slumped from Rs 1,568/- to a day low of Rs 1,411/-.

Today’s dent in market valuation alone costed the Indian conglomerate, more than Rs 40,000 crore.

The latest round of turbulence in Adani Group stocks came on back of claims by some Wikipedia editors that the apple-to-airport conglomerate manipulated Wikipedia entries with non-neutral PR versions.

Biggest fall in last 2 weeks

Today’s slump in the stock markets was one of the steepest fall for embattled business group in last two weeks. Ever since, US based short-seller firm Hindeburg Research made sensational ‘disclosures’ in its January 25 report , the Group has been in free-fall mode.

In less than a month after the damaging allegations by Hindenburg, the company has seen its market capitalization slide to more than Rs 11 lakh crore. In less than a month, Adani stocks have lost 60% of their valuation.

The US short-seller had accused the Adani Group of brazen stock manipulation and accounting fraud for charting its unprecedented growth. Though, the company rebutted all allegations and the billionaire himself sought to ally investor’s apprehensions but the latest set of allegations by Wikipedia editors has done the damage when it was just starting to ride the ‘recovery path’.