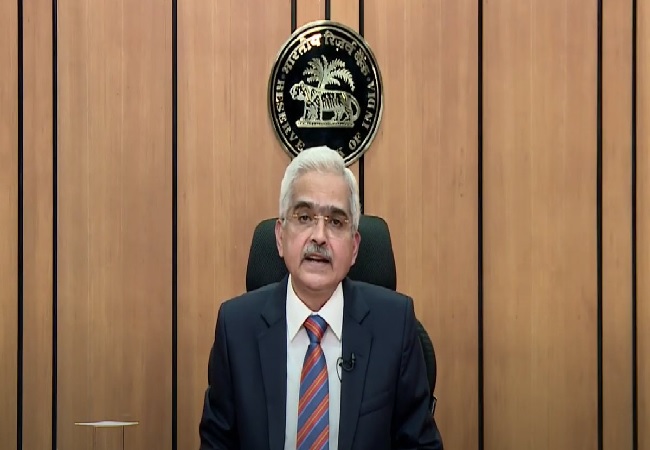

New Delhi: RBI Governor Shaktikanta Das on Friday said that MPC (Monetary Policy Committee) voted unanimously to leave policy repo rates unchanged at 4%.

“The Monetary Policy Committee met on 3rd, 4th and 5th February and deliberated on current and evolving macroeconomic and financial developments both domestic and global. The MPC voted unanimously to leave the policy repo rate unchanged at 4 per cent,” said Das.

“It also unanimously decided to continue with the accommodative stance of monetary policy as long as necessary at least through the current financial year and into the next year to revive growth on a durable basis and mitigate the impact of COVID-19 while ensuring that inflation remains within the target going forward,” he added.

TOP POINTS

While the year 2020 tested our capabilities and endurance, 2021 is setting the stage for a new economic era in the course of our history: RBI Governor Shaktikanta Das

He further said that inflation has returned to tolerance band (of 4 pc).

Outlook on growth turns positive; signs of recovery strengthen further.

Budget has provided impetus to health and infra sectors.

GDP growth is projected at 10.5% in Financial Year 2021-22.

Vegetables prices likely to remain soft in near term; inflation to be revised to 5.2 pc in Q4 of FY21

Govt to review inflation target for RBI by March 2021; inflation targeting has worked well.

Stance of liquidity management continues to remain accommodative in line with monetary policy.

Projection of CPI (consumer price index) inflation has been revised to 5.2% for Q4 of the current financial year

Watch LIVE : Monetary Policy statement by RBI Governor @DasShaktikanta https://t.co/t9x9SJ2SMP

— Prasar Bharati News Services पी.बी.एन.एस. (@PBNS_India) February 5, 2021

This is the first Monetary Policy discussed by the RBI Governor after the presentation of Union Budget 2021-22.