New Delhi: Different people have different perspective for the cryptocurrency market around the world. Some see it as an object of naked speculation which is consuming all the media coverage about the market. For such people, Wednesday was a bad day as the Bloomberg Galaxy Crypto Index crashed by 19.2%, worst slide in more than a year. On the other hand, some believe that the crypto space is the construction of a new financial system and for them Wednesday was a huge win. It might go down as one of the brightest days in the history of cryptocurrencies.

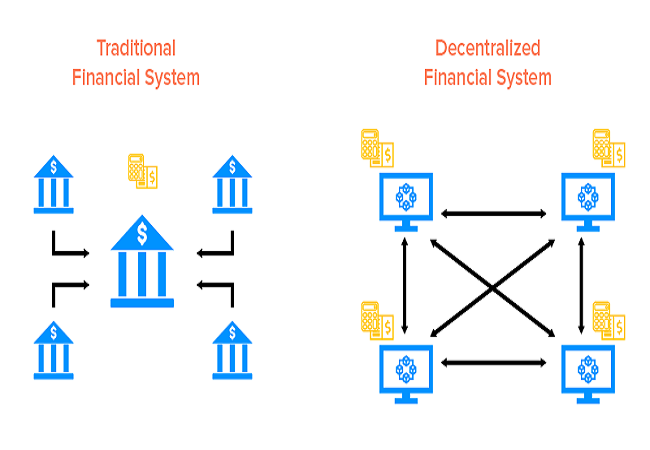

Even under extreme pressure, the system worked as designed. Some problems got uncovered, one being the high fees for trading at the most volatile moments. But it was a known problem because the crypto platforms are running at 100% capacity. People have been working on the solutions for more capacity and efficiency for months which are expected to be operational by year-end. To understand why Wednesday was a big step to success for crypto, separate the space into its two main categories: centralized and decentralized finance.

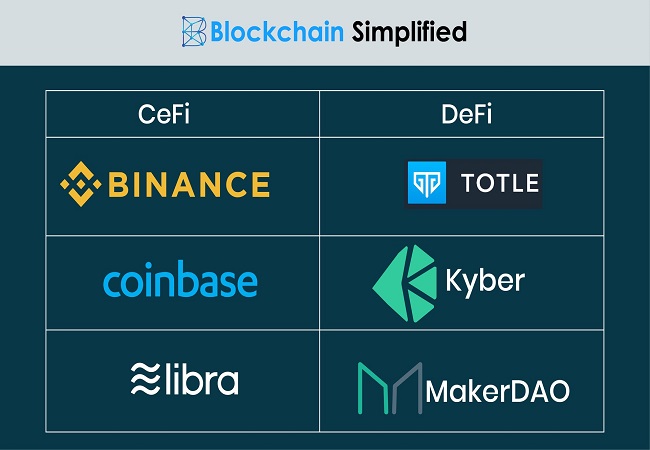

Centralized is the most familiar which consists of the regulated exchanges such as BlockFi Inc., Coinbase Global Inc. and Binance. These platforms run traditional order books which consist bids and offers similar to the New York Stock Exchange. And just like Robinhood Markets Inc. and similar traditional brokers, when markets become hectic, there are a lot of delays, system shutdowns and frustrating customer experiences. These events lead the experts to conclude that the crypto space is not yet ready for the prime time.

But the decentralized protocols, worked as designed and never went down. Even when the customers were frustrated by the market losses, they did not complain that these systems were failing them at a critical moments. As many are not familiar with decentralized finance, or DeFi, here are some details.

DeFi does not work on the order book system like regulated exchanges. Instead, it has over 72,000 liquidity pools and anyone can be a liquidity provider to these pools. One can even start his own pool and earn more coins for their effort. Traders use these liquidity pools to trade their crypto coins. The entire protocol is being managed by a computer code called an automatic market maker. There are no humans involved in the trading on such exchanges, the largest decentralized exchange is Uniswap. One must use an electronic wallet not registered on a regulated exchange and connect it to uniswap.org to access it. Uniswap allows customers to trade thousands of different cryptos. Uniswap founder Hayden Adams tweeted that Uniswap executed $6.3 billion of trades on Wednesday, larger than the Coinbase’s first quarter average of $3.7 billion.

Uniswap experienced no downtime, no slow service and none of the customer lost money because of the exchange’s bad performance. Compound is one of the largest lending protocols and by connecting to compound finance, one can take fully collateralized loans. Compound tweeted that its protocol “withstood the volatility flawlessly.”

This morning, crypto prices declined more rapidly than at any point in the Compound protocol’s history.

The protocol withstood the volatility flawlessly.

Today is a reminder to exercise caution when using leverage.

— Compound Labs (@compoundfinance) May 19, 2021

Polygon Technology is another protocol which allows developers to scale their decentralized apps so that they can offer faster and more efficient services. This is critical to the DeFi universe. Its founder Sandeep Nailwal tweeted that “DeFi stayed strong.” Even when some cryptocurrencies crashed by 50%, these platforms did not go down.

Hearing this a lot. When most of the CEXes went down @0xPolygon Defi stayed strong, people could do various things.

Elated for users to have such good user experienceMeanwhile hearing some strange things about Blockfi

Clearly DEFI is better than CEFI#EthIsScaling#DefiForAll https://t.co/MQYrhyCwzu

— Sandeep – Polygon(prev Matic Network) (@sandeepnailwal) May 19, 2021

Another website ‘bybt.com’ reported more than 840,000 traders bought cryptos on margin or leverage, using decentralized sites like Compound, AAVE or Maker. Such users saw more than $9.11 billion of positions liquidated automatically with the help of smart contracts. None of the decentralized protocols failed or needed a bailout. None of the regulators had to decide to close anything.

As the whole market is on blockchain, so, it is open and can be seen and analyzed in real-time letting everyone to see the liquidations and trading as they unfold. Anyone can bid to buy the remaining assets of a liquidated account.

So, as most of the world is focused on wild price fluctuations and unusual coins, investors need to understand that it was the traditional financial exchanges that once again failed them, not the decentralized finance. Which also means that those who claim that they are creating a new and better financial system have won in the end. While those who are behind the traditional foreign exchanges need to answer some really hard questions.