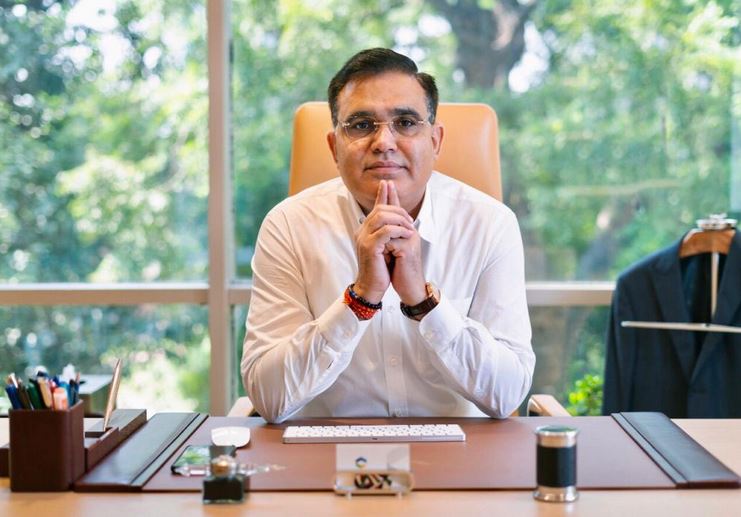

SK Narvar, Chairman, Capital India Corp, believes that the National Monetisation Pipeline (NMP) will help government generate resources for development without burdening the taxpayers with additional taxes and reduced external borrowing.

Excerpts follow:

Q — The National Monetisation Pipeline targets to generate Rs. 6 lac crores; how does it bode well for the Indian economy?

S K Narvar: Let me first congratulate PM Modi and his team led by FM Nirmala Sitharaman for this bold yet historic move. The Rs 6 lacs crore generated over next 4 years will be ploughed into new (greenfield) infrastructure projects that the country needs. Also, it doesn’t incur selling the asset but only leasing it for a long-term period; hence, the ownership of the asset remains with the government and the sovereign state.

It is a wonderful example of a public-private partnership – PPP model. While the government has readied the asset, the private sector players will run it on a day to day basis. It follows the government’s belief that government should limit itself in running businesses, and it is best for the private sector as they have the expertise, skills and capabilities.

Q — What is the larger strategy for rolling out the National Monetisation Pipeline, according to you?

S K Narvar: Globally, countries have followed the asset monetisation principle; the private sector is wary of investing a vast amount of capital in strategic greenfield infrastructure like roads, ports, airports, etc. as they worry about policy and other sensitive matters like land acquisition, regional politics and project timelines, etc. However, the country requires world-class infrastructure. Thus the government steps in and builds the assets in a time-bound manner. Once it is ready, the private sector is keen and has the expertise of running it on a day to day basis. The government leases such assets through competitive bids, generating and recouping its investments through revenue rights. These are again channelled into further infrastructure investments.

Q — Critics say that strategic assets built through taxpayers money are being sold to the private sector – is this view correct?

S. K Narvar: Let me explain it in detail – the above views are fallacious. First, the assets are not sold but leased for a certain period, with the private player has only the right to use the asset, not own it. Second, the money earned is further invested in newer infrastructure projects, creating value for the Indian taxpayer in a continuous and long-term manner.

For any such exercise, institutional checks and balances are always put in place. So be it floating global tenders, having independent auditors, specialised valuers and adjudicators, all of them will make the process transparent, efficient and as per international standards. Hence, the vision, intent and strategy are aligned to create value for the Indian citizen through better living standards and facilities.

Q — What is the biggest advantage for the government from such a program?

S K Narvar: Globally, it has been proven that running specialised infrastructure assets like roads, ports, airports, etc., on a day to day basis is not the core expertise of the government. It is better equipped towards policy making and implementing on-ground & make ready such mammoth projects.

The private sector has the expertise and specialised players with global expertise. So not only will the government earn upfront money as licence or operating fees, but in parallel, the private sector will bring in higher efficiency and cost benefits. With due oversee, regulators and market competition, it is a win-win approach.

Q — How does such a program help the country and economy as a whole?

S K Narvar: Any large infrastructure project not only creates direct economic gains but has an ancillary effect. For example, good roads lead to more people buying cars which help finance companies and ultimately benefits the second-hand car market. In addition, good city infrastructure and connectivity ensures better housing projects, schools & colleges, hospitals, etc. and reverses the migration to the metros.

The World Bank has observed that such programs are being implemented in various parts, especially developing nations. The lessons learnt are being used to fine-tune the program, and it is a continuous journey. As long as the risk-reward profile is democratically arrived at with protection to all players, monetisation will help countries build world-class infrastructure. It is a capital-efficient, revenue rights-oriented yet citizen-friendly model.